Since Prime Minister Harper changed his government’s policy on China, Canada is welcoming, indeed encouraging Chinese investment. According to Department of Foreign Affairs and International Trade, “The stock of foreign direct investment into Canada from China reached approximately C$14 billion at the end of 2010. Chinese firms are actively investing abroad and have expressed a strong interest in investing in Canada. Sectors of interest include natural resources, renewable energy, information and communication technology, food processing, pharmaceuticals and natural medicine, and advanced manufacturing.” [1]

Are Canadians concerned, should we be concerned? According to Canadian Press-Harris Decima survey in February 2012, 51% of Canadians welcomed Chinese investment in Canada, while 71% felt badly if Chinese companies took majority control of an existing Canadian-owned operation.

Canadians do have a few concerns about China’s investment in natural resources. First of all, most of China’s investors in natural resources and energy are State Owned Enterprises (SOEs), who are considered by many as government agents, raising concerns China ‘s government will control some of the natural resources in Canada through its SOEs; second, because China lacks enough of its own resources, there is concern it will exploit Canada’s natural resources too rapidly to fuel its development needs; third, China’s investors and collaborators in Canada might bring short term contract workers from China to work in Canada.

The BHP bid on Potash exemplifies these concerns. In Aug. 2010, BHP Billiton (Australia), the largest mining company in the world, offered $38.6 billion in a takeover bid for PotashCorp in Saskatchewan, the largest Potash producer in the world. Meanwhile, China’s SOE Sinochem was looking for potential partners to mount a counter-offer. The Conference Board of Canada completed a report “Saskatchewan in the Spotlight” to help the provincial government to make their decision. This report says “BHP Billiton’s proposed takeover of PotashCorp could reduce Saskatchewan government revenues by at least $2 billion over the next 10 years”. Under the scenario that Sinochem buys PotashCorp and adopts a “high production” approach, the possible reduction of revenue for Saskatchewan over a decade would be $5.7 billion. Eventually the bid by BHP Billiton was blocked by the Minister of Industry Tony Clement under the “net benefit to Canada” provision of Canada Investment Act on Nov. 3rd, 2010.

What’s interesting is that CBC held a poll online to solicit predictions on the BHP bid. 25.14% predicted that BHP would win the bid while only 9.85% thought China would buy PotashCorp. [2]

While the accelerated development concern seems real, the view held by many that most of China’s investment in Canada is in natural resources and energy does not match with results to date. In fact, Asia Pacific Foundation’s research on China’s investment in Canada shows that in 2010, 44% of China’s investment in Canada was in business service, while 8.3% was in mining, dropped from 10.4% in 2008. [3]

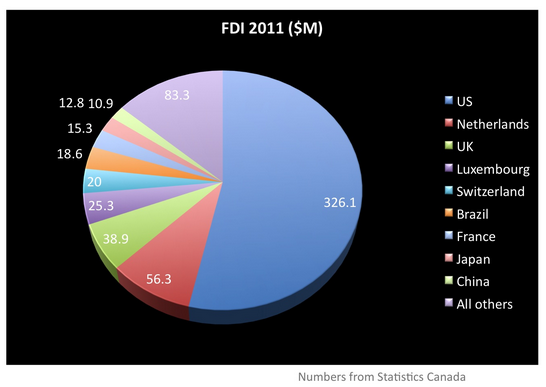

Another concern expressed is the danger of Chinese domination. While it is true that Chinese investment in Canada has grown significantly in recent years, its overall scale compared to America and Europe is still small. In 2011, US invested $326.1 million in Canada while China’s investment was only $10.9 million.

Finally, concerns are being raised about Chinese environmental performance. In June 2010, China published “Environmental Performance Guidelines for China’s Overseas Investment,” covering environmental impact assessment, protocol protection mechanism, ecological compensation and corporate social responsibilities.

One can only conclude at this time that, whether or not China or any other foreign investor is a problem for Canada, whether control of essential industries or sectors, domination of Canadian business, undesirable influence over decisions of strategic national importance or weakening of labour, public health and environmental protection, is up to us.

We need to strongly encourage our governments to protect our interests and not compromise under pressure from business to give priority to their ambitions. Regarding China, let’s take the opportunity to help Chinese investors make responsible investment in Canada, better inform them about CSR in Canada, and where needed pressure Chinese companies to be social and environmentally responsible in Canada, at home and around the world. In this way we not only protect our own interests but also contribute, as we should, to improving conditions globally.

Major investment from China in Energy & Resource in Canada in the Past Three Years

- Jan. 2012, PetroChina bought Athabassca Oil Sands Corporations’ remaining stake (40%) in the Mackay River project with $1.9 billion, which made PetroChina the first Chinese company having full ownership of an oilsands project

- Nov.2011, CNOOC acquired Opti Canada, a financially troubled Calgary company, with US$2.1 billion; in return, CNOOC gains a 35% stake in the Long Lake oil sands project.

- Oct. 2011, Sinopec bought Daylight Energy Ltd. for $2.2 billion.

- Aug. 2011, Jilin Jien Nickel would invest another $400 million in its nickel extraction project in Nunavik, which makes the total investment $800 million after it acquired Canadian Royalties Inc. in 2010.

- May, 2011, Baosteel purchased Noront Resources’s 9.9% equity with $17.4 million (the percentage could raise from 9.9% to 14.15% with extra $11.7 million)

- Apr. 2011, Jinchuan Group acquired Continental Minerals with $431 million

- Jan. 2011, Wuhan Iron & Steel Group (WISG) and Adriana Resources (ADI) signed agreement that WISG would pay ADI $120 million for a 60% participating interesting in a joint venture in the Lac otelnuk and December Lake iron ore properties in Northern Quebec

- Sept. 2010, XinXing Pipes Group Co. agreed to invest up to $1 billion into an iron ore mining project in Nunavut

- Aug. 2010, CRCC-Tongguan Investment Co., a jointed-owned direct subsidiary of Tongling Nonferrous Metals Group Holdings Co., Ltd. and China Railway Construction Corporation Limited, acquired 100% of Corriente Resources, a Vancouver based copper company, with $679 million.

- May 2010, CIC invested $1.25 billion to a joint-fund company with Penn West Energy.

- Apr. 2010, Sinopec paid USD$4.65 billion to Syncrude Canada Ltd. for a 9% stake in Syncrude owned by Conoco Phillip.

- Feb.2010, PetroChina completed the acquiry of Athabasca’s 60% interest of macKay and Dover oil sands projects.

- Dec. 2009, Yunann Chihong Zinc and Germanium Co. Ltd. and Selwyn Resources signed agreement for Chinhong to earn a 50% joint venture interest in the Selwyn project by spending $100 million on exploration and development.

- Oct. 2009, CIC invested $500 million in convertible bonds of SouthGobi Energy Resources Ltd. to help SouthGobi accelerate its coal mining and exploration activities in Mongolia.

- 2009, CIC invested $1.74 billion to buy 17% of Tech Resources Ltd’s equity.

- 2009, China State Grid Corp signed a MOU with Quadra Mining Ltd. (QuadraFNX Mining Ltd.) on an investment of $1billion.

- March 2009, Wuhan Iron and Steel Group (WISG) invested US$240 million and became the biggest shareholder of Consolidated Thomson Iron Mine Ltd. (CLM); it owns 19.9% of CLM’s share, 25% of CLM’s BloomLake project and 50% product from that project.

[4]

Sina.com (in Chinese)